Climate finance is the engine that turns climate action from an aspirational idea into tangible outcomes for communities and markets. By directing mitigation funding and adaptation funding, governments, businesses, and donors can accelerate clean energy, resilient infrastructure, and protective social programs. Smart green finance tools and climate investment strategies align public and private sector finance to lower costs, mobilize capital, and tighten the link between risk, reward, and real-world impact. This guide explains how funds flow, what instruments exist, and how organizations—from governments to businesses to nonprofits—can access and deploy resources effectively. From bold investments to measurable outcomes, the language of climate finance signals a shared path toward lower emissions, stronger resilience, and inclusive growth.

Beyond the label climate finance, the same idea is advanced through financing mechanisms that reward clean energy, resilient infrastructure, and sustainable development. This alternative framing uses terms such as emission-reduction financing, resilience funding, green capital mobilization, and eco-investment to reflect a broader ecosystem. In practice, these financial flows bring together public budgets, philanthropic grants, and private capital to support climate-smart projects. Understanding these synonyms and related concepts helps readers locate relevant information across policy, markets, and technology.

Climate Finance: The Driving Force Behind Mitigation and Adaptation

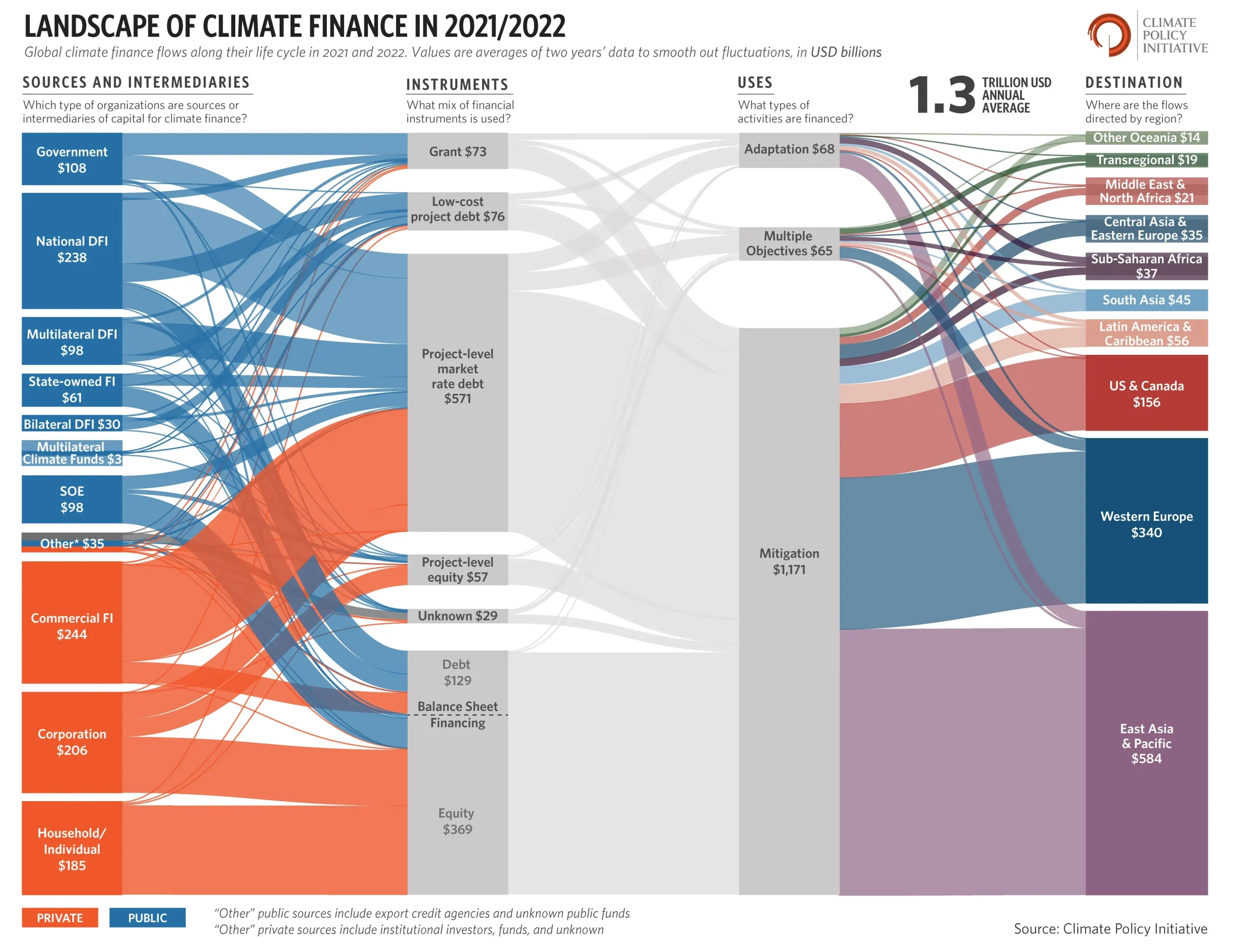

Climate finance is the engine that turns climate action into real outcomes, directing capital toward mitigation funding and adaptation funding. By channeling funds into renewable energy, energy efficiency, and resilient infrastructure, green finance and climate investment help reduce emissions while strengthening communities against hazards. This money comes from a mix of public and private sector finance, multilateral agencies, and blended arrangements designed to mobilize additional private capital.

Understanding the flow of funds requires recognizing instruments such as concessional loans, grants, green bonds, and performance-based financing. These tools align financial incentives with climate outcomes, enabling greater impact while maintaining transparency and accountability. The balance between mitigation funding and adaptation funding ensures that short-term resilience and long-term decarbonization go hand in hand, helping economies transition smoothly.

Governance, measurement, and credible data are essential to maximize impact. Public sources provide foundation and risk-tolerant facilities, while private capital scales up successful pilots. Blended finance can unlock projects that would be too risky through first-loss guarantees or credit enhancements, unlocking climate investment in new markets.

Strategic Pathways to Maximize Impact: Public-Private Climate Investment and Green Finance

To maximize climate finance impact, organizations should design bankable projects that attract both public and private sector finance. Blended finance blends grant funding and concessional capital with commercial finance to de-risk investments and accelerate deployment of mitigation funding and adaptation funding, while strengthening green finance ecosystems.

A strong project pipeline, alignment with national climate plans, and robust measurement enable access to concessional loans, grants, and ESG-aligned private investments. Emphasize climate investment through infrastructure, grid modernization, and resilience-enhancing measures, ensuring co-benefits such as job creation and health improvements, and focusing on equitable outcomes for vulnerable groups.

Governance and transparency matter: clear reporting, third-party verification, and open data foster trust with investors and donors. Public and private sector finance should be guided by clear exit strategies and risk-sharing arrangements to ensure sustained capital deployment and measurable climate results over time.

Frequently Asked Questions

What is climate finance, and how do mitigation funding and adaptation funding work together to advance climate action?

Climate finance is the funding that supports activities to reduce greenhouse gas emissions (mitigation) and strengthen resilience to climate impacts (adaptation). Mitigation funding finances clean energy deployment, energy efficiency, electrification, and decarbonization strategies, using instruments such as concessional loans, grants, green bonds, and results-based financing. Adaptation funding supports climate-resilient infrastructure, disaster risk reduction, climate-smart agriculture, and early warning systems, often blended with public funds to attract private capital. Together, mitigation funding and adaptation funding align capital with climate outcomes, mobilize public and private sector finance, and drive measurable emissions reductions and resilient development.

How can green finance and climate investment mobilize public and private sector finance to scale mitigation and adaptation projects?

Green finance channels private capital to climate projects through instruments like green bonds, sustainability-linked loans, and ESG-compliant investments, while climate investment refers to strategic allocation of funds toward scalable decarbonization and resilience. Public finance—national budgets, climate funds, and development banks—can catalyze private capital via blended finance, first-loss guarantees, and risk-sharing. Private sector finance follows market demand for sustainable assets and risk-adjusted returns, guided by transparent reporting and climate-risk disclosure. To succeed, funders should develop bankable project pipelines, align with national climate plans, and maintain strong governance and measurement of climate outcomes, expanding the reach of mitigation and adaptation initiatives.

| Topic | Key Points |

|---|---|

| What is climate finance? | Funding that supports activities aimed at reducing emissions, enhancing energy efficiency, scaling up renewable energy, and strengthening resilience against climate risks; aims to align capital with climate outcomes and mobilize private investment. |

| Core goals | Mitigation (reduce emissions) and Adaptation (increase resilience); both are central goals of climate policy. |

| Sources of funding | Public finance (budgets, aid, development banks), international climate funds (e.g., Green Climate Fund), private finance (green bonds, sustainability-linked loans, equity), blended finance to unlock private capital. |

| Key instruments | Grants, concessional loans, green bonds, results-based financing, blended finance, risk guarantees. |

| Mitigation funding focus | Long-term decarbonization, deployment of renewable energy, energy efficiency, electrification, and low-emission tech; instruments include concessional loans, grants, green bonds, results-based financing. |

| Adaptation funding focus | Resilience-building: climate-resilient infrastructure, climate-smart agriculture, early warning systems, disaster risk reduction; robust and flexible funding; blended finance support. |

| Accessing climate finance | Governments: bankable pipelines and measurable outcomes; private sector: risk-adjusted returns and ESG alignment; nonprofits: feasibility studies and capacity building; strong governance and transparency are essential. |

| Best practices | Evidence base, bankable solutions, blended finance with clear governance, alignment with policy, focus on co-benefits, governance and transparency. |

| Case studies | Green Climate Fund (GCF) mobilizes private investment; green bonds scale climate projects; credible pipelines and robust measurement frameworks are crucial. |

| Path forward | Expand capital pools, improve flow efficiency, innovate instruments, ensure inclusion of vulnerable groups, stronger governance and data to accelerate progress toward net-zero and climate-resilient future. |

Summary

Climate Finance is the engine that turns climate action into tangible outcomes by aligning incentives, reducing risk, and directing capital toward both mitigation and adaptation. By understanding the sources of funding (public budgets, international climate funds, development banks, private capital) and the instruments (grants, concessional loans, green bonds, blended finance, results-based financing), stakeholders—from governments to businesses to nonprofits—can design programs that maximize impact, ensure transparency, and deliver measurable emissions reductions and resilience gains. Effective Climate Finance requires robust governance, credible measurement, and inclusive access so that vulnerable communities share the benefits while accelerating the transition to a net-zero, climate-resilient future.