Climate finance sits at the intersection of investment strategy and the urgent need to curb greenhouse gas emissions. It mobilizes public, private, and philanthropic capital toward projects that reduce emissions, advance energy efficiency, and build resilience in communities worldwide, while tools such as blended finance unlock private capital and catalyze local jobs and innovation beyond borders. As policymakers and business leaders align net-zero ambitions with capital allocation, climate finance becomes a catalyst for low-carbon investments and sustainable finance across sectors, from energy and transport to agriculture and manufacturing. Investors gain clarity as instruments like green bonds and blended finance illuminate use-of-proceeds, enable measurable impact, and create opportunities that balance risk, return, and environmental outcomes, supported by third-party verification and ongoing impact reporting. Smart carbon pricing, robust climate risk assessment, and transparent reporting help markets allocate capital efficiently, reducing volatility while accelerating decarbonization and value creation for customers, communities, and shareholders alike.

Viewed through a broader lens, this capital activity is often described as green finance, net-zero funding, or climate-aware investing that channels resources toward decarbonization and resilience. Markets price externalities and guide allocation through sustainable finance products, carbon-conscious risk management, and governance that rewards clean technology adoption. A mix of labeled debt, ESG mandates, and blended finance helps fund renewable energy projects, energy efficiency retrofits, and climate adaptation initiatives at scale. This language emphasizes transition finance, resilience funding, and eco-friendly capital flows that translate environmental benefits into predictable return streams for institutions and individuals. By combining these terms with practical governance and disclosure practices, stakeholders build a coherent, future-oriented financial system that supports sustainable growth.

Climate finance: Aligning capital with a low-carbon, resilient future

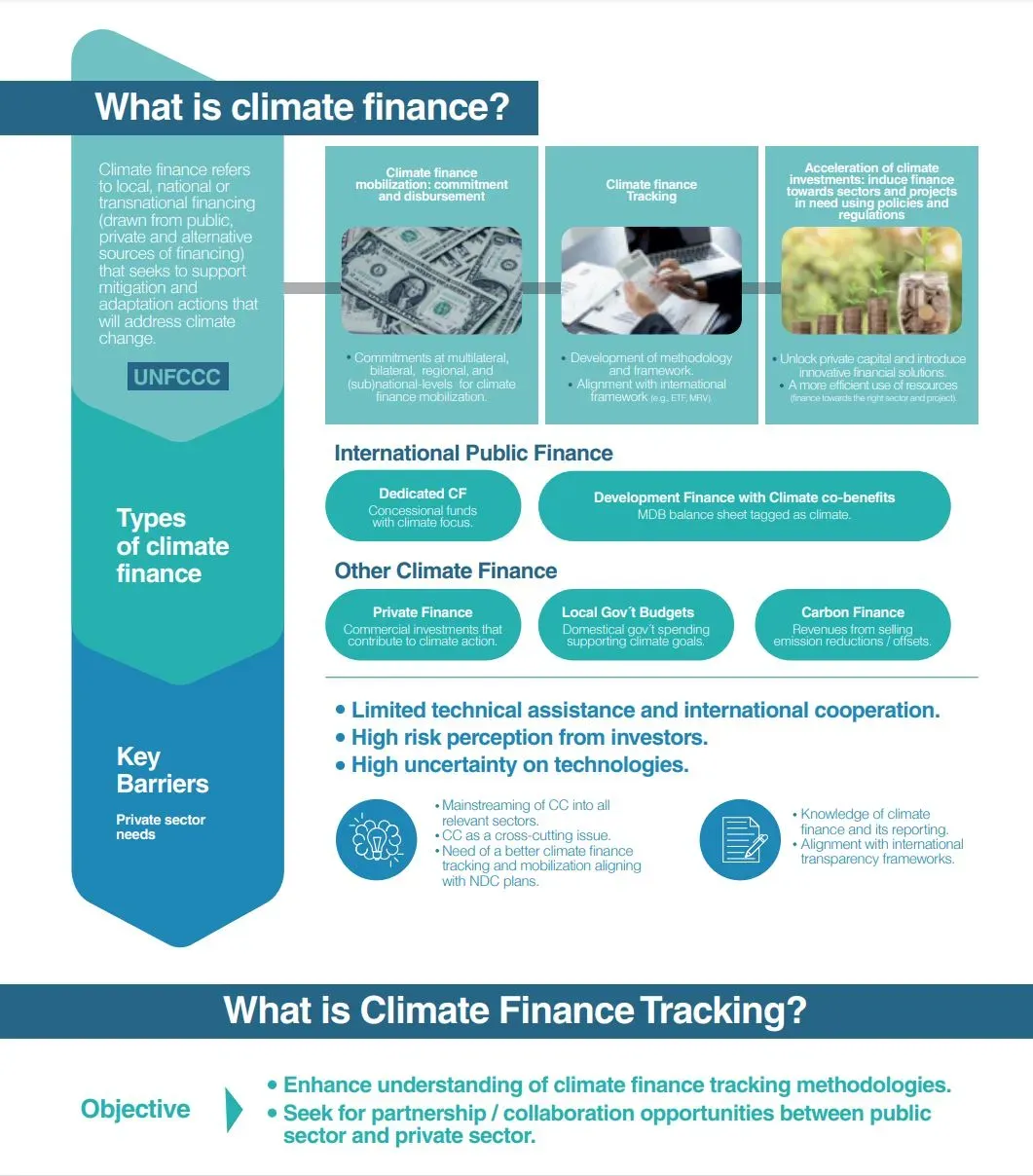

Climate finance mobilizes public, private, and philanthropic capital toward projects that reduce emissions, remove carbon from the atmosphere, or strengthen resilience to climate impacts. This flow of funding fuels a broad spectrum of low-carbon investments—from renewable energy generation and energy efficiency upgrades to climate-resilient infrastructure—creating scale, accelerating deployment, and spreading risk across sectors.

Beyond funding, climate finance relies on disciplined risk management. Climate risk assessment tools, scenario analysis, and the pricing of climate risk help investors and executives understand how temperature outcomes, policy shifts, and technology change affect asset values. By aligning capital with climate outcomes and embedding transparent reporting, financial decisions support long-term sustainability within sustainable finance practices and drive measurable environmental and financial results.

Instruments and governance driving sustainable finance and green growth

Green bonds, sustainable and ESG-focused funds, blended finance, and public-private partnerships are the core instruments moving capital toward climate-smart outcomes. These tools channel funding to low-carbon investments, providing clear use-of-proceeds reporting and measurable impact that resonates with investors seeking sustainable finance that integrates environmental and financial returns.

Together with standardized disclosures—such as TCFD-aligned climate risk disclosure—these channels enable investors to price climate risk accurately and support decarbonization journeys. Carbon pricing regimes and transition finance further align incentives, helping companies fund decarbonization programs, retrofit initiatives, and the scale-up of clean technologies while maintaining financial resilience.

Frequently Asked Questions

What is climate finance and how does it support low-carbon investments?

Climate finance mobilizes public, private, and philanthropic capital toward projects that reduce emissions and strengthen resilience. It channels funding through tools like green bonds and sustainable finance strategies to support low-carbon investments, while incorporating climate risk assessment to price risks and guide capital toward decarbonization. By aligning capital with climate outcomes, climate finance aims to deliver measurable environmental impact alongside solid financial returns.

How do carbon pricing and climate risk assessment influence decisions in climate finance?

Carbon pricing raises the cost of emitting greenhouse gases, incentivizing investment in cleaner technologies and energy efficiency. Climate risk assessment analyzes how physical and policy-related risks could affect asset values under different climate scenarios, informing capital allocation and risk management. Together, these mechanisms steer investors, corporates, and policymakers toward climate-smart opportunities and expand financing through instruments like green bonds and sustainable funds.

| Topic | Key Points |

|---|---|

| Definition and purpose | Climate finance aligns money with climate outcomes; directs capital toward reducing emissions, removing carbon, and strengthening resilience; prices carbon risk; emphasizes measurable impact via reporting frameworks. |

| Risk management motivation | Key driver is managing climate risks (physical like floods; transitional like policy shifts) by channeling capital to climate-smart solutions to reduce volatility and unlock investment-grade opportunities. |

| Landscape and players | Ecosystem includes central banks, supranational and development banks, commercial banks, asset managers, pension funds, sovereign wealth funds, insurers, and climate-focused funds; public finance catalyzes private investment. |

| Instruments and channels | Green bonds; ESG-focused and sustainable funds; blended/concessional finance; public-private partnerships; carbon pricing and regulation; climate risk disclosure and stewardship. |

| Real-world examples | Cities issue green municipal bonds for transit and efficiency; pension funds shift toward climate-aligned assets to reduce stranded-asset risk and capture clean-energy opportunities. |

| Risk management and disclosure | Adopt frameworks like TCFD, perform scenario analysis, inform capital allocation, hedging, and investor confidence through credible disclosure. |

| Carbon pricing and transition finance | Carbon pricing creates cost signals; transition finance supports decarbonization projects and acknowledges transitional assets in the shift away from high-carbon activity. |

| Case studies | Municipal green bonds for transit and building upgrades; pension funds reallocating to climate-focused assets; insurers increasing climate-resilient investments. |

| Practical steps | Define objectives; integrate climate risk into due diligence; diversify across instruments; establish measurement and reporting; build internal capability; engage with policy and market developments. |

| Measuring impact & avoiding greenwashing | Transparent reporting of outcomes and processes; robust verification and third-party assurance; standardized disclosures; clear use-of-proceeds. |

| Future outlook | The climate finance market is poised for growth as costs fall and policy momentum grows; climate risk becomes a material financial factor guiding capital toward decarbonization. |

Summary

Climate finance is the backbone of the transition to a sustainable, low-carbon future. It requires clear objectives, robust risk assessment, credible impact measurement, and transparent reporting. As markets evolve, the most successful participants will blend rigorous financial analysis with a clear decarbonization pathway, leveraging instruments like green bonds, ESG funds, and blended finance to scale climate solutions. Whether you are an asset owner, an investment manager, a corporate treasurer, or a policymaker, embracing Climate finance means choosing portfolios, projects, and policies that optimize both value and planetary health. The future belongs to those who invest with foresight, accountability, and a commitment to a resilient, net-zero world.