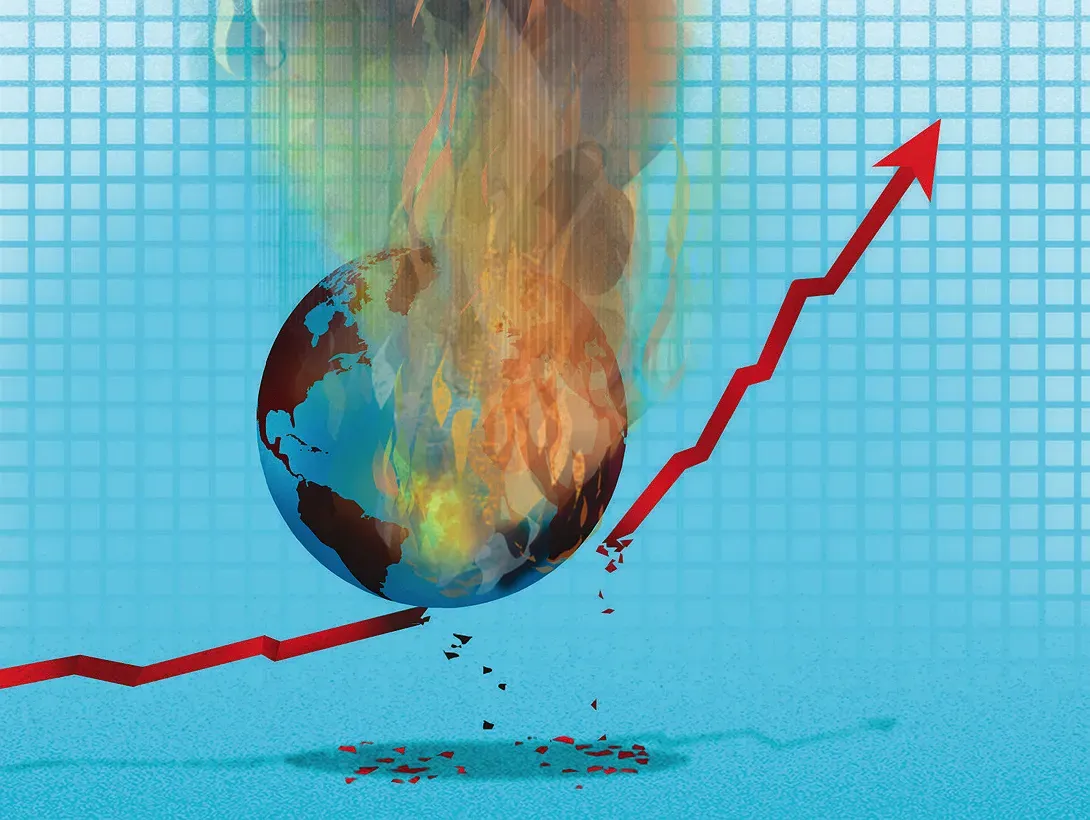

Climate Change Reshapes Global Economics is no longer a niche topic but a defining driver of policy, finance, and everyday business decisions. As the planet warms and extreme weather becomes more frequent, governments, firms, and households face new costs and new opportunities in global markets. This convergence forces policy design and market behavior to adapt, with climate policy shaping risk, incentives, and capital flows. Carbon pricing, whether through emissions trading or taxes, becomes a central instrument to align private actions with social costs while supporting green finance and sustainable development. By understanding these dynamics, leaders can navigate policy, markets, and investment opportunities with clarity.

Beyond the headline terms, the topic unfolds as a bundle of shifts in risk, investment, and policy signals. Analysts describe this as a recalibration of asset allocation toward resilience and decarbonization, with financial markets pricing in physical hazards and the costs of transitioning. Companies are reconfiguring supply chains, adopting energy efficiency, and pursuing climate-aware strategies that help protect margins while opening new revenue avenues. Governments signal a sustained energy and industry reform—through standards, subsidies, green procurement, and public-private programs that guide capital toward low-emission technologies. For investors and policymakers, the emphasis is on transparency, scenario planning, and credible roadmaps that reduce uncertainty during the transition. The overarching aim is inclusive growth, balancing energy access and affordable goods with emissions reductions and environmental stewardship.

Climate Change Reshapes Global Economics: Policy, Markets, and Growth in a Warming Era

As the planet warms, climate risk embeds itself in growth projections, inflation dynamics, and capital allocation. Traditional macro models that assumed stable energy prices and predictable weather are giving way to frameworks that account for adaptation costs and transitional dynamics toward a low-carbon economy. Countries with different energy mixes and resilience capacities experience divergent growth paths, as climate shocks raise input costs and price volatility while the expansion of cleaner energy, energy efficiency, and climate-resilient infrastructure creates new opportunities for innovation. Global markets are re-pricing risk, reallocating capital toward more resilient sectors, and pricing in the cost of inaction.

At the core is climate policy as an instrument of macroeconomic design: carbon pricing, performance standards, clean energy subsidies, and green procurement rules not only reduce emissions but also redefine cost structures and competitiveness. When aligned with financial policy, these tools steer investment toward green finance products—green bonds, climate-aligned debt, and transparent risk disclosures—helping markets price and manage climate risk and accelerate progress toward sustainable development.

Investing in Resilience: Green Finance, Global Markets, and Sustainable Development Under Climate Policy

Investors increasingly price climate risk into asset valuations, and global markets vary in sensitivity based on governance, transparency, and resilience. Green finance instruments—green bonds, climate-aligned debt, and mandatory risk disclosures—channel capital toward adaptation, decarbonization, and resilient infrastructure, while carbon pricing signals shape risk premiums and sectoral allocations.

Policy coherence and credible long-term plans are essential to keep markets calm and sustain investment in the green transition. Firms and governments that integrate climate policy with energy transition strategies can expand opportunities in sustainable development, strengthen supply chains, and access lower-cost capital through green finance channels.

Frequently Asked Questions

How does Climate Change Reshapes Global Economics affect global markets and investment decisions in today’s policy-driven environment?

Climate Change Reshapes Global Economics is reshaping global markets by changing how risk is priced, capital is allocated, and forecasts are built. As climate policy tightens and carbon pricing mechanisms mature, incentives shift away from carbon-intensive activities toward low‑carbon technologies and resilient infrastructure. This reorientation boosts demand for green finance products, improves transparency through climate risk disclosures, and influences asset prices and borrowing costs across sectors. Ultimately, sustainable development considerations guide both policy and corporate strategy, encouraging diversification and productivity gains while embedding climate risk into long‑term planning.

What role does carbon pricing play in Climate Change Reshapes Global Economics, and how does it influence green finance and sustainable development?

Carbon pricing is a central instrument in Climate Change Reshapes Global Economics. By valuing carbon through emissions trading or taxes, it internalizes climate externalities, shifting investment toward clean energy, energy efficiency, and low‑carbon innovation. The price signals guide capital toward sustainable projects and enhance the appeal of green finance—green bonds, climate‑aligned debt, and robust risk disclosure. When designed with credible, gradual trajectories and social safeguards, carbon pricing reduces policy risk, supports a stable transition, and accelerates sustainable development by directing capital to activities that lower emissions while expanding opportunity and growth in the global economy.

| Key Theme | What It Means | Implications for Policy/Business |

|---|---|---|

| Macro level shifts | Growth trajectories, inflation dynamics, and capital allocation are increasingly influenced by climate risk, adaptation costs, and the transition toward a low‑carbon economy. Regional differences in energy mixes and resilience affect productivity and price volatility. | Policy planning must incorporate climate risk; anticipate cost pass‑throughs, volatility, and opportunities from low‑carbon investments; tailor strategies to regional conditions. |

| Policy shifts | Climate considerations become central to macro frameworks. Carbon pricing (emissions trading or taxes) aims to align private incentives with social costs; other tools include standards, subsidies, and green procurement. | Policy credibility and cross‑border alignment are essential; expect shifts in competitiveness, cost structures, and regulatory risk depending on carbon rules. |

| Finance and investment | Green finance, sustainable investing, and climate risk disclosures shape capital allocation; investors seek clarity on exposure and readiness for a low‑carbon future. | Asset pricing and cost of capital will reflect climate risk; instruments like green bonds and resilience insurance will grow; risk management becomes mainstream for both public and private sectors. |

| Global trade and supply chains | Trade patterns, energy costs, and logistics reliability are influenced by climate policy and resilience measures; nearshoring or onshoring may rise. | Investment geography and regulatory standards will shift; firms must diversify supply chains and align with environmental rules and tariffs. |

| Energy transition and innovation | Move from fossil fuels to lower‑emission sources drives investment in grid modernization, storage, and advanced manufacturing; innovation accelerates but transition costs must be managed. | Stable policy signals and social safety nets are needed to balance decarbonization with economic and worker resilience; economies that pair ambition with pragmatism may gain a competitive edge. |

| Global markets’ climate risk response | Markets price climate risk into credit and equity valuations; banks and asset managers apply stress tests and scenario analysis to gauge exposure. | Expect volatility and opportunities; leadership in resilience and credible climate policy can attract capital and boost long‑term returns. |

| Sustainable development focus | Decarbonization must be balanced with development needs—energy access, affordable goods, and quality jobs—while reducing emissions. | International cooperation and targeted investment in clean technologies and social protection enable inclusive, sustainable growth. |

| Leadership and policy practice | Leaders should mainstream climate risk into budgeting, adopt credible carbon pricing trajectories, and invest in green finance and workforce transition. | Policy stability, workforce support, and alignment with consumer demand for sustainability are key to guiding a just transition and maintaining growth. |

Summary

Conclusion