Climate risk management is the compass for navigating today’s volatile environment, where extreme weather, shifting regulations, and supply-chain disruptions threaten assets and profitability, and it sets the foundation for proactive value protection. By embedding climate risk assessment for assets into governance and planning, organizations can map exposure, strengthen resilience, and align with climate risk management strategies. Asset protection in volatile markets becomes actionable through resilience planning for businesses and robust stress testing and scenario analysis that stress-tests capital, supply chains, and operations. A practical program integrates risk assessment for assets, scenario testing, and diversified sourcing to safeguard cash flow and maintain performance even as climate threats evolve. Ultimately, the goal is to anticipate, adapt, and advance, turning climate-related challenges into opportunities for smarter investment, stronger governance, and sustained competitive advantage.

From an alternative framing, the topic can be described using terms like environmental risk governance, weather-related exposure management, and decarbonization risk planning. This is an LSI-informed approach that emphasizes business continuity, hazard mapping, and risk-adjusted capital allocation to keep operations resilient as regulations evolve. Instead of focusing on a single discipline, it becomes a structured program of proactive planning, data-driven analysis, and cross-functional collaboration that protects value across assets and supply chains. In short, this lens highlights how resilience, governance, and informed decision-making work together to navigate climate-related uncertainties.

Climate Risk Management: Strategies to Protect Assets in Volatile Markets

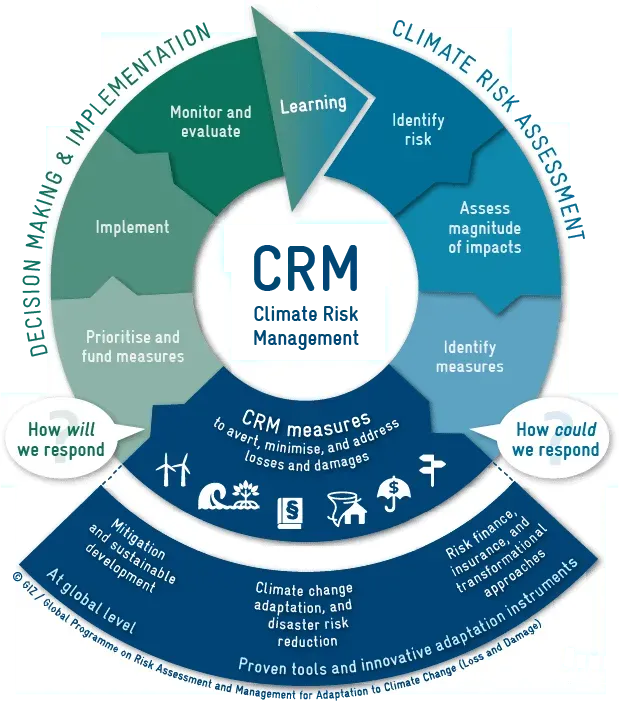

Climate risk management strategies are increasingly essential for defending both physical and financial assets from floods, heat exposure, and shifting regulatory landscapes. By mapping asset exposure across locations, assessing vulnerability, and prioritizing protective investments, organizations can reduce loss potential in volatile markets. This approach treats climate risk as a spectrum that interacts with market dynamics, technology adoption, and policy changes, guiding decisions on durable facilities, flood defenses, resilient supply chains, and insured protection to safeguard asset values and long-term profitability.

Strong governance and disciplined decision-making enable asset protection in volatile markets by embedding climate risk into enterprise risk management and budgeting. Regular scenario planning and stress testing reveal gaps in capital, liquidity, and insurance, informing risk appetite and capital allocation adjustments. A robust climate risk assessment for assets that considers short-, medium-, and long-term horizons across multiple climate trajectories (1.5°C, 2°C, and 3°C futures) helps stress-test asset performance, anticipate disruptive events, and refine contingency arrangements.

Climate Risk Assessment for Assets and Resilience Planning for Businesses

Effective climate risk assessment for assets begins with collecting exposure data, evaluating vulnerability, and translating findings into actionable insights. By examining physical risks—flooding, heat stress, and extreme weather—and transition risks—decarbonization, technology shifts, and policy changes—organizations can identify critical assets and design targeted resilience measures. Integrating resilience planning for businesses into daily operations reduces disruption duration and strengthens recovery through diversified siting, elevated protections, robust maintenance, and diversified supplier networks.

With governance and operational integration, resilience planning for businesses becomes a strategic lever. Regular stress testing and scenario analysis help anticipate extreme but plausible events, guiding capital planning, insurance optimization, and contingency arrangements. A comprehensive climate risk assessment for assets informs decision-making about asset protection in volatile markets, linking climate insights to investment appraisal, project approvals, and long-horizon value creation while reinforcing supply-chain resilience and business continuity.

Frequently Asked Questions

What are climate risk management strategies, and how do they support asset protection in volatile markets?

Climate risk management strategies address physical, transition, and liability risks to protect asset values and ensure continuity. A climate risk assessment for assets identifies exposures across facilities, equipment, and supply chains, while scenario analysis tests resilience under multiple futures (for example, 1.5°C, 2°C, and 3°C). By applying diversification, protective upgrades, risk transfer, and strong governance, organizations can improve asset protection in volatile markets and strengthen their balance sheets during climate shocks.

Why is climate risk assessment for assets, along with stress testing and scenario analysis, essential for resilience planning for businesses?

A climate risk assessment for assets reveals where physical and financial assets are vulnerable to climate hazards, informing resilience planning for businesses. Stress testing and scenario analysis show how shocks propagate through capital, liquidity, and operations under different futures, guiding prudent budgeting and capital allocation. Integrating these insights into governance and day-to-day decision-making helps organizations maintain operations, protect value, and seize climate-related opportunities.

| Key Topic | Key Points |

|---|---|

| Introduction | Climate shocks disrupt operations, assets, profitability; climate risk management turns theory into practical value; integrate data, governance, disciplined decision-making; anticipate, adapt, and advance; defend balance sheet, safeguard supply chains, and sustain performance in volatility. |

| Asset Protection | Identify physical assets exposure to climate hazards; cover financial/intangible assets (brand, trust); climate risk is a spectrum interacting with market dynamics, tech adoption, policy; map interactions to prioritize investments that reduce risk while enabling growth. |

| Scope of Climate Risk Management | Three categories: physical risks (floods, heat waves, storms), transition risks (decarbonization, new tech), liability risks (regulatory penalties, lawsuits, reputational damage). |

| Risk Assessment | Collect data on exposure, vulnerability, resilience; consider multiple time horizons (short/medium/long-term) and climate trajectories (1.5°C, 2°C, 3°C); scenario analysis visualizes impacts; stress testing reveals capital planning, insurance, and contingency gaps. |

| Resilience Planning | Not about preventing all disruption but reducing severity/duration; cross-functional governance; integrate disaster response, business continuity, and recovery; physical assets: siting, flood protection, cooling, maintenance; intangible assets: protect data, vendor relationships, IP during shocks. |

| Asset Protection Strategies | Physical adaptations (flood defenses, wind standards, climate-controlled storage); financial hedging, insurance optimization, risk transfer; operational: diversify suppliers, regionalized production, dual sourcing. |

| Governance & Integration | Embed climate risk in risk appetite, budgeting, capital planning; boards understand risk-reward trade-offs; tie risk controls to strategy; embed in ERM; regular stress tests, equity-impact analyses, liquidity assessments. |

| Practical Steps to Implement | Map exposures; prioritize actions; build resilience into design; strengthen supply chain; test aggressively; integrate into decision-making; monitor and adapt. |

| Case Study & Real-World Implications | Manufacturing example with flood exposure; protective upgrades; diversified routes; scenario-analysis; robust insurance; reduced downtime; preserved commitments; demonstrates value of assessment, resilience, asset protection. |

| Future-Proofing & Value Creation | Goal: create value, lower expected losses, preserve asset values, maintain investor confidence; proactive governance; disclosures; risk-adjusted performance; opportunity to invest in green measures, efficiency, climate-aligned products. |

Summary

HTML table above summarizes the key points of the base content in English.